“Don’t try to get the market to pay for things.”

It’s an old saying and it rings true to this day. The looks I get from people when I tell them that I trade stocks, or at least know something about it, is either one of amazement (“Wow, you must be really rich to trade AND travel!”) or disgust (“Oh, yea? I knew a guy who… blah blah blah). It is possible, however, to trade the markets and travel the world.

Anyway, you don’t see it too often and many people don’t really disclose their accounts, neither will I. I can tell you this much: there hasn’t been much over the last year. Yes, the market went up and, if you were wise you bought and hold, but if you tried to trade your way through the markets, you most likely got your ass handed to you. There are some who make a living trading the stock market, but what you need to know and understand about them is that they didn’t start at the top and it took them a while to get things going. With that, I hope this post dispels any idea that you can, and will, make money tomorrow and then jet set around the world. Good luck.

For those who have an inkling of interest of the market read on as I will try my very best to make it really simple for you. I’m a fan of simplicity. As a matter of fact, one lady I met while travelling said there’s nothing difficult with investing in stocks, you just need to use your “farmer’s brain.” By that she meant don’t over-think things. If the season (up trend) is up, buy and wait patiently; if it’s not (down trend), sell and wait patiently.

Use your “farmer’s brain”: don’t over-think things.

A realistic note: you won’t become rich in the stock market overnight. Most of the famous and well-off investors are frugal people who don’t spend a lot of money, if any at all, on luxury items. What that means is: don’t quit your job in the expectation that you’ll be able to trade your way to freedom. Like most successful businesses, stock trading is best built up over time and in conjunction with someone else paying the bills, such as the company you work for.

First things first

Should you trade? This is an important point to consider before throwing some coin into the mosh pit of trading. Lots of folks have this mistaken conception that they will get rich over night in the stock market. I’m sorry to burst your bubble but, it probably won’t happen. Even the most successful traders have jobs, even if that job is trading itself. By that I mean, they are getting paid by someone else to trade. Not all, of course; there are some who make a go of it on their own and do very well. In any event, the key is to figure out whether or not you yourself are capable of trading. The easy part of trading is buying, anyone can do it. It’s especially exciting watching your numbers go green and move from single to double to triple digit gains. Fair enough.

The easy part of trading is buying, anyone can do it. The hard part is to sell.

The hard part is to sell. What do you do when those numbers turn red, as in, you’re losing money? Just consider your investments in terms of the hours and things you’ve done at your job to make back any lost money: how many sheep you’ll have to lift? Coffees to pour? Backpackers to check in? Snotty kids to smile pleasantly at in order to make back your money?? It’s at times like those that they can test your guts and emotions. Let me tell ya, it ain’t fun. Losses come with the territory and the key is to be able to admit that you were wrong, sell, and move on to the next investment.

Consider your investments in terms of the hours and things you’ve done at your job to make back any lost money.

There is no pride to be had by holding on to a losing position. The stock market does not care who you are or what you do, all it does it keep track of the deals being made and the price at which they are being made. That being written and done, ask yourself if you have what it takes to properly and profitably invest your money. Sheeit, I’ll tell you after seven years of trading I still ask that question!

The stock market does not care who you are or what you do, all it does it keep track of the deals being made and the price at which they are being made.

Finding stuff to buy

There are a variety of things you can buy ranging from simple stocks (like Coca Cola and Apple) to commodities (wheat, gold, etc.) to options (contracts to buy stuff later in time for a certain price) to ETFs (“baskets” of assets like commodities or stocks) to FOREX (foreign currencies) and beyond. There’s a lot of stuff to buy. Like lots and lots of different stuff to buy. So how do you know what to buy and when to buy it?

The news might give you some idea of what to buy, but, as you learn more about investing, you’ll realize that the news is generally behind on the good to great investments. Another way, the so-called “technical analysis” method, is to use stock scans, such as those found on stockcharts.com or finviz.com or any other number of charting websites. Yet another way to find good stocks is to set up a list of criteria such as the CANSLIM list that William J. O’Neil came up with. Or, you could go way out on a limb and read science magazines, travel around a bit, and converse with others to find unique investing ideas.

Keep in mind, these are just ideas. Just because you hear about a great stock idea or, even worse, receive a “tip”, you must evaluate the company and its stock price before committing your hard earned capital. Why? Because if the stock tanks you’re the one holding the bill. No one will refund your money for a bad investment. It pays, then, to do some research on any idea you get, especially those “tips”.

No one will refund your money for a bad investment.

The Popular Delusions and Madness of Crowds

Now, caveat emptor (trans: buyer beware)! When a stock hits the news, you can be sure that the pros are starting to unload that stock on you, the unknowing public. If you want to read about the basics of how to manipulate the market, read the last few chapters of Edward Lefevre’s Reminiscences of a Stock Operator. The book, loosely based on the life of Jesse Livermore, will give you a very good glimpse at how the markets work. I especially love the second last chapter (ch. 23) in which good ol’ JL explains how the experts sell their stock: the media quotes “a person familiar with the matter,” “a top executive,” or some other “expert” without ever naming them.

The effect, then, is that you hear that somebody important (are they really?) is doing something (but what?) and, without doing any research yourself you go ahead and buy or sell as the case may be. Keep in mind what I wrote above about you being left with the bill. It’s sensible to become a bit of a contrarian, a dirty word in the financial world because it refers to a person who sees and hears what’s going on, and does the opposite of what the news instructs. I’m not suggesting doing the opposite all the time, but read, watch and listen to the news with a healthy dose of skepticism. The news is like one big tip generator: it informs you about what others are buying or selling but, at the end of the day, you need to evaluate the available information and make your own trading decisions.

At the end of the day, you need to evaluate the available information and make your own trading decisions.

Stock charts: Stock price history in picture format

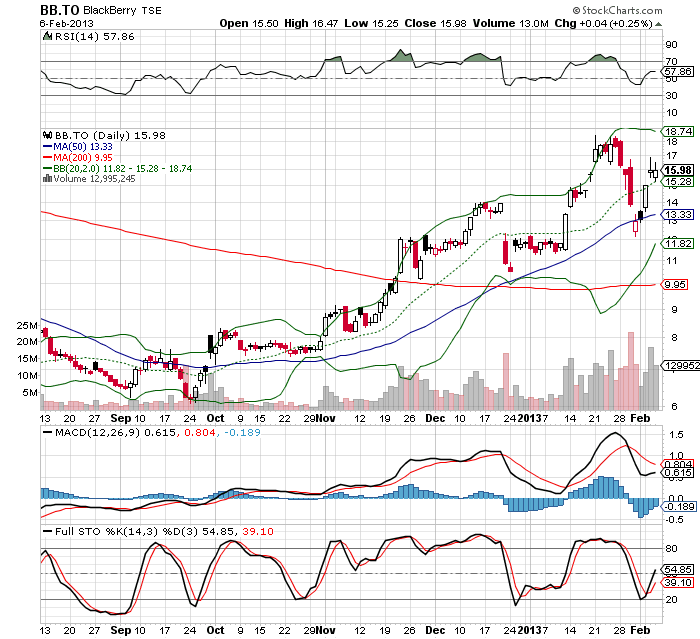

Lots of people are grossed out and confused by stock charts. They see all those lines and numbers and colours and begin to have epileptic seizures like the kids at the Full Moon Party. Well, fear not, most successful investors will tell you to keep things simple. Like, real simple. A couple of moving averages to gauge entry and exit points, volume to determine whether or not anyone is actually buying the thing, and trend (is the stock going up, going down or, like most times, going sideways). That’s pretty much about it. A stock chart, in essence, is a picture of a stock price’s history. Older traders didn’t have these types of charts way back when they started out. Now we do. Use them to your advantage.

Here’s one for you. This is for A Company Formerly Called Research In Motion (aka, Blackberry). You might have heard of them at some point. What follows are three charts, two from the Canadian exchange, one from the American exchange.

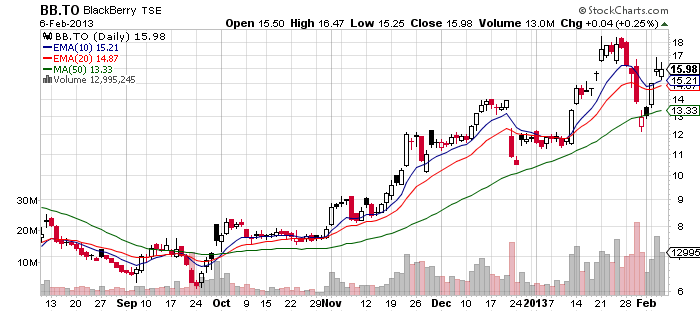

Is this one better?

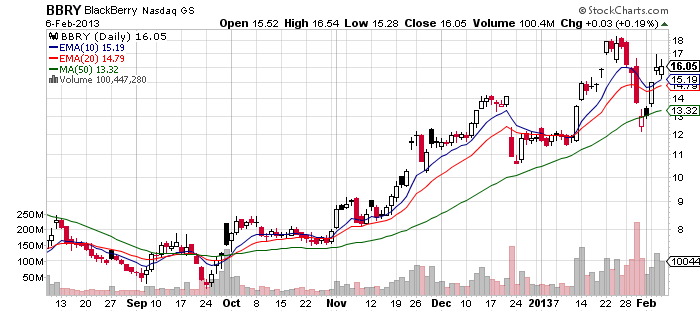

And I’ll include the NASDAQ chart so some aren’t confused by the “.to” (Toronto)…

Basic Economics

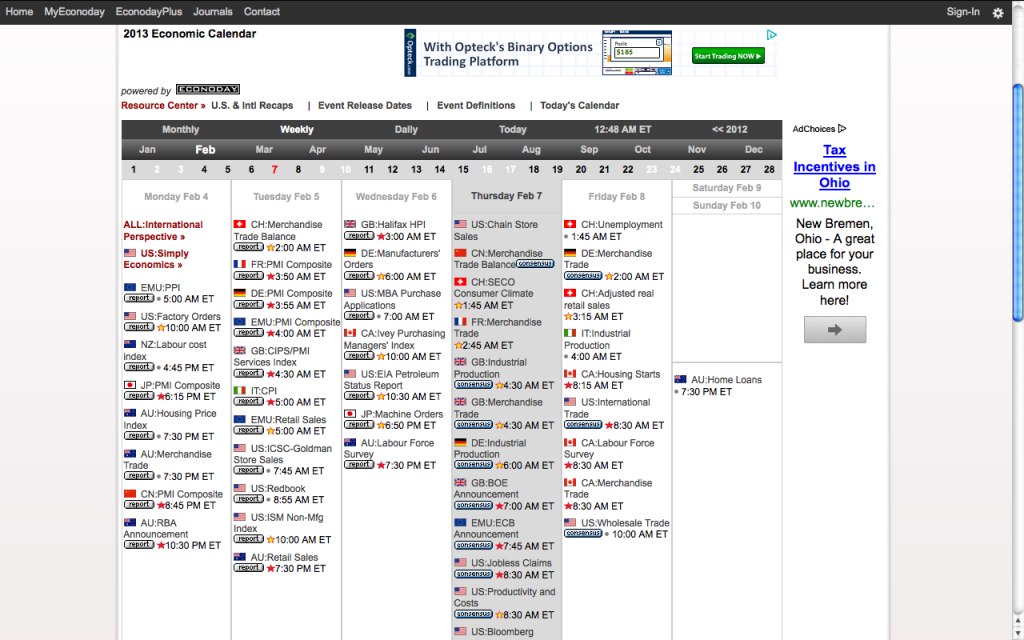

There’s a lot of bad news going around these days, despite the fact that the market has gone up considerably over the last four years. And I can only imagine that in a matter of time the news will turn rosy but the markets will go kerplunk. So it goes. But the basis of the economy is income versus expenses which are often determined by supply and demand. We make something and sell it to others, how much did it cost us to make and how many people are buying it? How much of it do we have to make in order to break even, turn a profit or lose our money? Often you’ll hear about some government report or announcement that Some Important Number came out above or below expectations and the markets reacted. Things such as PMI, CCI, MA, FOMC, blah blah blah all “move the market” by way of their influence on investors both large and small. There’s so much news sometimes that it makes your head spin.

Often you’ll hear about some government report or announcement that Some Important Number came out above or below expectations and the markets reacted.

More Reading

If you’re sick and puking because of all the jibber jabber above, then maybe you’re interested enough to do some more reading on how the market works and how to put your money to work for you. Here are some classic investing books that you might be interested in:

- Reminiscences of a Stock Operator by Edward Lefevre

- How I Made $2,000,000 in the Stock Market by Nicolas Darvis

- The Battle for Investment Survival by Gerald M. Loeb

All three are a little dated but the information they convey is as relevant as ever. If those don’t suit your fancy and you just want to get trading then I suggest some “how to” books:

- How to Trade In Stocks by Jesse Livermore

- How to Make Money in Stocks by William J. O’Neil

- Trading for a Living: Psychology, Trading Tactics, Money Management by Dr. Alexander Elder

- Trader Vic: Methods of a Wall Street Master by Victor Sperandeo

That should get you started and test you to see if you’re actually interested in learning how to trade the markets. Hmmm… maybe I should start a website or something.

Finally, one last bit of wisdom that’s been handed down form successful trader to successful trader:

Don’t lose money.